By Mina Bloom and Ariel Cheung

Photography by Sebastián Hidalgo

Lesley Gonzalez grew up in Chicago’s historically Latino neighborhood of Logan Square, on the young end of the Millennial generation and as the only child of Mexican immigrants. Visual traces of her childhood lingered in the tiny studio apartment at 2936 W. Palmer Street years after she’d reached adulthood. “We left my growth spurts on the wall, and in my closet, I stuck stickers that are still there,” recalls Lesley, now 21. “It was something I knew my whole life.” It wasn’t perfect — her parents slept in the living room each night — but it was home, and her small family was a happy one. Lesley’s parents saved up for their daughter’s college education and for a dream of their own: becoming full American citizens, an expensive but long-desired goal. (Gonzalez is Lesley’s paternal grandmother’s maiden name. Because Lesley’s parents are undocumented, we have chosen to protect the family’s identity.)

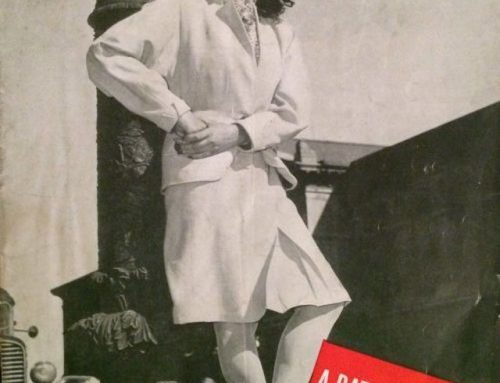

Photo at top of page: Lesley Gonzalez and her mother returning to their former block in the Logan Square neighborhood of Chicago. After living there for 17 years, a developer bought their building and evicted them. As rents in the neighborhood have soared beyond their means, the Gonzalezes now live four miles north, far from the community they’re accustomed to. Above: The Gonzalezes’ old apartment building in Logan Square, which now sits next to a newly constructed building with high-income appeal.

“For me, it was the best apartment,” says Lesley’s father, Javier, who makes a little less than $15 an hour working as a machine operator for a packing manufacturer in Des Plaines, Illinois. Combined with his wife’s hourly pay as a cook, the family could afford the roughly $500 rent and still put some money aside for the future. So when prolific developer M. Fishman & Co. bought their building and kicked out more than a dozen families this past October, it devastated the Gonzalezes. They were ripped from their home, and they faced what felt like an insurmountable task: Finding a new apartment with comparable rent. “I broke down. I found myself worrying about where I’m going to live, as opposed to what homework I have to do,” says Lesley, who is studying graphic design at Columbia College Chicago. “All I wanted was some sort of stability, like, ‘OK, Lesley, you have a place to go. You can concentrate on school again.’”

The Gonzalez family has a story that is far from unique: In record numbers, tenants in Chicago are being displaced from their homes and, all too often, from their communities — neighborhoods where family and friends form tight bonds, sometimes over the course of generations. Neighborhoods like Pilsen, a Mexican immigrant enclave for more than half a century. There, the loss of 10,000 Latinos in the past decade is attributed by many as a consequence of developers scooping up old, cheap properties in culturally rich neighborhoods, razing them and building new, expensive homes that attract a wealthier — and often whiter — cohort.

The Gonzalez family has a story that is far from unique: In record numbers, tenants in Chicago are being displaced from their homes and, all too often, from their communities — neighborhoods where family and friends form tight bonds, sometimes over the course of generations.

The Gonzalezes, themselves, were priced out of Logan Square, another historically Latino neighborhood, after they lost their studio. They resettled about four miles north, in Chicago’s Irving Park neighborhood. Their new apartment is bigger and arguably better: Two bedrooms, a modern kitchen, room for bookshelves in the living room. But it comes at a steep cost: They pay $1,300 in monthly rent, nearly three times what their rent used to be. Lesley works 35 hours a week to help the family make ends meet and to cover her tuition, which her parents can no longer contribute to. The family’s savings, intended to fulfill Javier and Lucero Gonzalez’s dream of citizenship, go toward housing costs instead.

They’re getting by, but only just. Everyday purchases like new clothes have become luxuries. “Before, when I went to the store, I could buy a pair of shoes or pants, but now, I can buy nothing,” Javier says. “The most important thing is to fix our legal status, [but] living here makes it more difficult.” Meanwhile, their longtime home back on Palmer Street is undergoing renovations that will likely drive the cost of living there far beyond the Gonzalez family’s means.

While the Gonzalezes were forced to leave Logan Square, many Chicagoans in a similar predicament have left the city entirely. In 2016, Chicago suffered its third consecutive year of population loss, losing 8,638 residents, according to census data. (And there’s every indication that the final 2017 numbers will follow the downward trend.) In theory, Chicago should be less expensive as a result; fewer people increases the housing supply. But experts say it’s not that simple. The housing bubble gave way to a lot of new development, almost all of it involving luxury apartments. Meanwhile, many of Chicago’s two- to four-flats, which make up the city’s affordable housing stock, have either been demolished or have fallen into disrepair. Between 2000 and 2015, average Chicago rents have increased more than 60 percent, forcing low-income residents to leave the city in search of cheaper housing. What can be done for families like Lesley’s is a question the city’s urban planning experts and community activists alike have been pondering, hoping to find a solution as more and more people leave Chicago. Two years ago they landed on rent regulation as a way of keeping Chicago affordable.

Support independent, context-driven regional writing.

But before supporters of rent regulation can make any headway in developing a system that both stabilizes rental prices and incentivizes landlords to adequately maintain their buildings, there is a state-size hurdle to overcome: the Rent Control Preemption Act of 1997, which bans Illinois municipalities from enacting any type of rent regulation. While critics say any governmental oversight regarding rental prices would imperil landlords and stymie the rental market, supporters insist that without putting something in place, rents in Chicago will continue to climb — displacing communities of color and low-income renters and draining neighborhoods of deeply embedded cultures — and the city’s already dwindling population will plummet as residents seek stability elsewhere. Already, more than half of Chicago renters put at least 30 percent of their income toward rent — a figure the federal government defines as unaffordable.

“Either we’re going to lose hundreds of thousands of people because they can’t afford to live here, or we’re going to do something,” says community organizer Jawanza Malone. “Elected officials have to come to the realization that there really is no alternative.” With the city’s much-touted affordability at stake — something Mayor Rahm Emanuel himself boasted of while courting a new Amazon headquarters — activists like Malone are rallying support and pushing for legislation to lift the Illinois ban on rent regulation with an eye toward stabilizing the cost of living in Chicago.

Some say it could happen as soon as next year.

***

The March 20 primary looms large for these activists, who put a rent regulation referendum on the ballot in nearly 100 Chicago precincts, which will allow 20,000 voters to take a stance on the issue. Meanwhile, legislation to repeal the statewide ban is winding its way through the Illinois general assembly, and the March 20 primary will help determine who will be at the governor’s desk if the bill lands there next year. Given how unpopular the concept of rent control is among Republicans, the bill is unlikely to pass with businessman-turned-politician Gov. Bruce Rauner still in power, says Illinois State Rep. Will Guzzardi, a Democrat who introduced the bill to overturn the ban. “If we win Democratic seats [in the general assembly] and have a Democratic governor who cares about these issues, I think the prospects look a lot better,” he says. “If Rauner gets re-elected, then it’ll be worse.” Guzzardi is confident that with new leadership, he can get the bill out of sub-committee, where it has been collecting dust for months, and hold a hearing on the issue so both supporters and opponents can make their case.

Chicago residents listen intently at a Feb. 19 community meeting about rising rents, gentrification, and rent control at the St. Pius Church in the Pilsen neighborhood. The meeting was organized by the Pilsen Alliance.

An affable former journalist, Guzzardi made waves five years ago when, at just 26 years old, he handily defeated the daughter of a powerful, well-connected Cook County Democrat in the race for the 39th District Illinois House seat, exciting progressives. “I think it’s really important to demand big changes, to demand systemic changes, transformational changes, even if you know you’re not going to win them today, tomorrow or the next day,” Guzzardi says.

In keeping with that philosophy, he joined forces with the Lift the Ban Coalition, a task force forged by four community-based organizations demanding those systemic changes on behalf of renters in diverse neighborhoods like Pilsen, Uptown, Kenwood and Bronzeville. The coalition’s leaders stress the point that Guzzardi’s legislation would not enact rent control in Illinois or even dictate how such a system would work. It merely gives municipal governments the ability to introduce such measures, should they wish to. In other words, it gets the conversation started. So does the referendum, which will be “pretty compelling,” Guzzardi says, “even if it’s only a couple thousand people who end up voting on this.”

Jawanza Malone, a co-founder of Lift the Ban and executive director of the Kenwood Oakland Community Organization, has heard from some of these voters already over dozens of meetings, culminating in a town hall in Bronzeville last fall where hundreds came to hear what rent regulation would mean for Chicagoans like them. “Regardless of who we’ve spoken with, they recognize that economic well-being is something that everybody wants, and something people should have access to,” Malone says. “I think the question that raises for people is how to do it.”

Frank Avellone, a Chicago attorney with the Lawyers Committee for Better Housing, has been fighting for renters who are unfairly evicted or dealing with homes falling into disrepair since 2013. He sees rent regulation as just one-third of the puzzle that would slow gentrification. Avellone would also like to see proactive rental inspections that tie in tax breaks for responsible landlords and the elimination of no-fault evictions. On average, 70 eviction cases are filed each day in Chicago. Of those, more than one in four are filed without cause, as new owners clear out buildings to remodel or demolish them entirely. Developers “go into neighborhoods like Pilsen, buy up properties and hand out 30-day notices,” says Avellone. “And no matter how much the tenants try to bargain with the new owner, it’s extraordinarily difficult, because this no-fault eviction is being held over their heads.”

Between 2000 and 2015, average Chicago rents have increased more than 60 percent, forcing low-income residents to leave the city in search of cheaper housing. In 2016, Chicago suffered its third consecutive year of population loss.

As for rent regulation, supporters of Lift the Ban, like Avellone, are quick to clarify that rent stabilization and rent control are different from one another in a very distinct way: Landlords can still raise stabilized rents to accommodate for cost-of-living increases or to offset rehabilitation or other physical improvements. Historically, rent control sets a hard cap on rent, but only for certain residents. In New York City — perhaps the most discussed example of rent regulation — tenants must be living in their apartment continuously since before July 1, 1971, in a building constructed before 1947 in order to qualify for rent control. This is a situation that allows a tenant to pay 1971 rent for an apartment that could be worth millions of dollars in 2018.

Rent stabilization is far more common than rent control. Roughly half of New York City’s apartments are rent-stabilized, while a mere one percent are rent-controlled. In New York City, landlords of rent-stabilized apartments can only raise the rent by a percentage determined by the Rent Guidelines Board. The policy applies to buildings of six units or more constructed between 1947 and 1974.

Regardless of the distinctions, many Chicago real estate professionals argue that rent regulation of any kind would actively harm Chicago landlords and renters alike. Brian Bernardoni, senior director of government affairs and public policy for the Chicago Association of Realtors, says any variation of the policy would discourage buildings from being built and would therefore hurt the housing stock. With a limit on rent, there would likely be a decline in property maintenance, he says, adding that the regulation would lead to an increase in property taxes caused by devaluation of the rental real estate base. “Assume 40 percent of the homes you have are residential,” argues Bernardoni. “If those buildings devalue, meaning there’s no market and the pricing goes down, what ends up happening is the tax rates need to go up on single-family and commercial properties, making Chicago and Cook County much less attractive for investment.”

Bernardoni plans to work with lobbyists to kill Guzzardi’s bill. He believes that Chicago renters would be better served by the construction of more high-density affordable housing and, regardless, says Chicago isn’t a good fit for rent regulation because rents haven’t reached levels similar to New York City or San Francisco. “We aren’t, despite the allegations, a high-rent city — an NYC rent threshold is $2,700,” says Bernardoni, referring to the cap in which rent-stabilized apartments in New York City become unregulated. “That’s not Pilsen. That’s not what you’re getting for an owner-occupied building there.”

But advocates of overturning the ban want to get measures in place to prevent Chicago rents from ever reaching New York City levels. Byron Sigcho, director of The Pilsen Alliance, which is part of the LIft the Ban Coalition, says, “Let’s have legislation now, when it matters, instead of saying down the road, ‘Now that rent is up to $4,000, let’s do rent control.’ Then it’s a completely different debate.” As part of The Pilsen Alliance’s work to increase affordable housing in the majority-Hispanic neighborhood, Sigcho says he’s met countless families who’ve spent decades in Pilsen, only to be forced to leave their close-knit community. One elderly woman, unable to afford rent in Pilsen after she was evicted, eventually resettled in a rental property near Midway International Airport — only to have her new home foreclosed on three months later.

***

A new luxury apartment building overshadows a small red house on Lyndale Street in the Logan Square neighborhood.

Even those who are in favor of repealing the ban on rent regulation acknowledge the policy isn’t a silver bullet. If lawmakers really want to make the city more affordable, housing activists say, they must not only preserve existing affordable housing, but also create new affordable housing. It’s a difficult task for a city embroiled in a financial crisis, but some urban policy experts say all it requires is some creative thinking.

Rather than pay for new construction, the city could acquire existing multifamily buildings and reserve something like 20 percent of the units as affordable housing. The city could also fund new projects using capital bonds or similar investments. It comes down to making affordable housing a priority, experts say.

As for rent regulation, although the concept has been debated in this country by economists, lawmakers and scholars since at least World War I, actual policies only exist in Washington, D.C., and a handful of U.S. states, including New York, New Jersey, Maryland and California.

In California, a trio of Stanford University graduate students recently published a two-year-long study, “The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco.”

Using both private and public data, the researchers found that while rent stabilization has increased renters’ probabilities of staying in their homes by nearly 20 percent, it has also reduced the housing supply by 15 percent and led to a 5.1-percent citywide rent increase. In other words, existing tenants have seen benefits, but future residents stand to lose, according to co-author Rebecca Diamond.

“We find for tenants that are living in San Francisco at the time of the law change, they are made better off by rent control. They get to experience below market rent in properties they lived in at the time the law suddenly covered them,” says Diamond, referring to 1994, when the city voted to expand rent control across San Francisco. Without rent control, the researchers found, “all of those incentivized to stay in their apartments would have otherwise moved out of San Francisco.” However, rent control also “likely contributed to the gentrification of San Francisco” due to its negative impact on the housing market as a whole, the study found. More specifically, such policy has unintentionally pushed developers to build housing that caters to the wealthy.

“I do think what’s at stake here is the foundation of Chicago as a blue-collar, working-class city.”

The study also found that 10 percent of rent-controlled properties in San Francisco are likely to be converted into condos via a loophole provided by California’s 1985 Ellis Act, which allows landlords of rent-controlled apartments to get out of the rental business, if they so choose. “That’s part of the policy that can be tweaked: Raising the revenue in a different way, as opposed to putting the full burden on the landlords,” Diamond says, pointing to government subsidies and tax credits as possible sources of funding.

Indeed, offsetting the impact rent regulation would have on landlords is vital to its success, says Janet Smith, a professor at University of Illinois at Chicago who oversees research on affordable housing, neighborhood change and community development. A city like Chicago would also have to carefully map out where it enacted such measures, adjusting for major development like the planned Obama Presidential Center or when the more affluent flock to culturally rich communities like Pilsen, outbidding middle- and low-income families for homes and driving up rents. “If you institute rent control in areas like Logan Square, where does the push happen then?” Smith says. “If you draw a boundary, rents are likely to go up on the other side of it.”

Like San Francisco, New York City has a tight rental market with an extremely low vacancy rate, whereas there are huge swaths of Chicago that are underpopulated, namely the South and West sides. “On the South Side, the rents may be going up a little, but the bigger problem has been vacancy and abandonment,” says Mark Willis, senior policy fellow at the NYU Furman Center, a nonpartisan organization that does research on housing, neighborhoods and urban policy. “You certainly don’t want to prevent landlords from charging enough to maintain their buildings.”

That’s just one reason New York City is different from Chicago. Construction costs are much higher, as are rent thresholds. Plus, there’s a lot less crime. And yet, despite having rent regulation, New York City is still one of the most expensive cities in the country. Willis explains the irony this way: “We’re already at a higher plane, so you want to ask: Would rents overall go up faster without [rent control and rent stabilization]? That’s the question.”

The jury is still out on whether rent regulation is doing more good than harm in New York City. Recently, the NYU Furman Center did a study that found 60 percent of tenants living in rent-stabilized apartments in New York City are low-income, earning less than 80 percent of the area median income. But other reports show landlords are increasingly skirting the law by converting their buildings into condos that cater to the wealthy.

In Chicago, without some means of regulating rising rents, advocates fear the city’s population — particularly its working class — will continue to decline as residents seek out more stable places to live. “I do think what’s at stake here is the foundation of Chicago as a blue-collar, working-class city,” Sigcho says.

Even if the ban is repealed in Illinois, supporters say it faces its own particular challenge in Chicago: Mayor Rahm Emanuel. “There’s so many things he could have done differently to demonstrate he cares about poor people and renters,” Smith says. Mayor Emanuel’s Affordable Requirements Ordinance, for example, lets developers buy out of affordable housing requirements, and affordable housing advocates say the requirement to make 10 percent of units affordable falls short of what’s needed.

But, lawyer Frank Avellone notes, there have been signs that officials are at least starting to pay attention to the issue, pointing to the 2013 Chicago Renting Ordinance that provides financial assistance to renters who are evicted from foreclosed properties. “When our side shows up, decision-makers will understand that it’s in their interest to be on the side of the citizens,” he says, crediting affordable housing advocates with efforts that have led to laws that protect renters.

Those in support of lifting the ban on rent regulation in Illinois say that, with the referendum coming on March 20 and the possibility of Guzzardi’s bill passing this year, rent regulation could be debated by Chicago City Council as early as 2019 — just in time, some note, for the mayoral race.

***

Lesley and her parents acknowledge they’re luckier than many families who have been displaced, mainly because they have three sources of income. “We don’t have little kids, but there was basically a newborn in the building. For them, it was harder than it was for us,” Lesley says of other tenants forced to move out of 2936 W. Palmer St.

Lesley and her father in their new apartment in Irving Park, where the rent is nearly three times higher than their old apartment.

It’s difficult, Lesley says, to see her parents struggle to make ends meet after more than two decades in Illinois. About 23 years ago, Lesley’s parents moved from Mexico City to Chicago in search of a better life. While living in Mexico, Javier made $2 a day working as a taxi driver, despite having earned an accounting degree from a technical college. But when the couple moved to Chicago, Javier got a job at a leather manufacturing company, where he made more than $10 an hour. From there, Javier went on to work at other factories, eventually landing at the packing manufacturer in Des Plaines.

For most of Lesley’s life, the Gonzalez family lived in the studio, tucked in a vintage building overlooking Palmer Square Park. During that 17-year stay, the rent only went up $100, according to Javier. But a major rent increase is in store for future tenants now that M. Fishman & Co. is in charge of the building, if the developer’s past projects are any indication. Mark Fishman, who runs the company, owns dozens of properties in the neighborhood and has a reputation for fixing up old buildings and hiking up the rent, making him a target for housing activists who fight gentrification. Fishman did not respond to a request for comment.

“Sometimes the greed of others puts lower-income people in a worse position than they’re already in.”

“I’m so proud to say my parents are immigrants, and because of them, I’m going to school and becoming a better person for this country,” Lesley says. “But sometimes the greed of others puts lower-income people in a worse position than they’re already in.”

Since Lesley and her mother work at a restaurant in Logan Square, they still spend a lot of time in the neighborhood. Recently, they walked past their old building at 2936 W. Palmer St. and saw construction workers inside their studio doing renovations. For Lesley, it was a sad reminder that their studio, the only home she ever knew, no longer belonged to her family.

She can’t help but wonder: Who’s going to live there when renovations are complete? “Hopefully, the people who move into the apartment appreciate how beautiful the view of the park is, and how pretty the sunlight is in the mornings,” Lesley says. “It was something we liked.”

Support for this article was provided by Rise Local, a project of New America.

To support more journalism made by and for people who live in the Midwest, become a member of Belt Magazine starting at just $5 a month.

Mina Bloom is a reporter for the forthcoming neighborhood news website Block Club Chicago, a nonprofit started by former editors of DNAinfo Chicago. She, too, worked for DNAinfo, where she went from covering crime and mayhem and Uptown and Andersonville to, most recently, her home neighborhood of Logan Square, plus Humboldt Park and Avondale. Mina’s work has also appeared in the Chicago Sun-Times, Eater and Chicago Magazine. Find her on Twitter @mina_bloom_ and on Instagram @minabloom.

Ariel Cheung is a senior editor for Modern Luxury Chicago and previously worked for DNAinfo Chicago as a neighborhood reporter covering the West Loop, Pilsen, Lakeview and Wrigleyville. Find her on Twitter and Instagram @arielfab and at www.arielcheung.net.

Sebastián Hidalgo is a freelance visual journalist based in the Midwest.

Good intentions do not necessarily lead to good outcomes. Rent control would hurt the same people they’re trying to help. You can’t repeal the law of supply and demand. It’s Economics 101: price ceilings cause shortages. Price controls on housing will lead to a housing shortage.

What a bunch of bunk.

First, as far as your “historically Hispanic” description of Pilsen and Logan Square, your author needs to brush up on their history! While there may be large Hispanic populations now, in the grand scheme, they are relatively recent arrivals to those neighborhoods. Logan Square used to be known as the Polish Gold Coast and the area is still home to a sizable number Polish-Americans. Pilsen was also predominantly European with Poles and Czechs making up the bulk of residents until the 1980s.

Second, Chicago doesn’t have an affordability problem. This fact was glossed over in the article, but there are plenty of areas in the city that are affordable, but they are not, for the most part, white neighborhoods. Why aren’t the affordability warriors focusing on these areas?

Ironically, the soft anti-white tone of the anti-gentrification crowd is soaked in hypocrisy. Funny how no one says a word when stable, white neighborhoods change to an ethnic minority, but when whites come back to neighborhoods they previously inhabited, there is suddenly all this hue and cry about greed, fairness, and dentrification.

The market has a way of sorting out this stuff. Let people live wherever their FICO scores and incomes allow. No one is entitled to an apartment or house in a nice area just because they want it. Likewise, anyone who has been in this country for nearly a quarter century, but never bothered to become a citizen doesn’t get any sympathy from me whatsoever.

Bash away.

Hello,

Thanks for reading.

Latino settlement in Logan Square started in 1960. While you’re correct that other ethnic groups were predominant before then, it’s not wrong to use the word “historically” here.

Did you not read that they are becoming residents of the United States? The process can take up to twenty years. Clearly you are unaware of this.

CJ, You are correct about the process of change in neighborhoods. Logan Square, in addition to its large Polish-American residents was heavily Jewish in the past and the neighborhood was originally almost totally Norwegian-American. Almost all of Chicago’s neighborhoods have seen demographic change over the years, sometimes offering the development of homogenous communities and sometimes opening them up to be multi-cultural. No group “owns” a neighborhood forever and, in most cases, this process has a more positive than negative affect over time…as values decrease, it offers opportunities for poorer residents, as values increase the aging housing stock is restored or replaced adding vibrancy

to our city.

The studio in which Lesley lived never belonged to her family. While I understand that nobody wants to be displaced due to gentrification, this happens all the time in major cities. If you don’t own your property, you are at risk of displacement. Renters do not have a right to live in a neighborhood forever. Pilsen and Logan Square were not originally Hispanic. Times change and so do neighborhoods.

Oh, and to further add to my point, their family were very lucky the rent on their studio apartment only increased $100 over the course of 17 years. And it seems disingenuous to compare the housing costs of a studio apartment vs a 2 bedroom and then claim that their rent almost tripled after the move.

Hi Chris,

Thanks for reading.

All we’re saying is their rent tripled after their move, which is undisputed. We’re not comparing the housing costs of a studio apartment and a two-bedroom apartment. The Gonzalezes tried to stay in Logan Square, but the rents were too high. They got way more bang for their buck in Irving Park.

Rent control or stabilization has almost no chance of passing in Chicago or Illinois. And, funding by the government at different levels for acquisition and development does not necessarily or efficiently translate to rents low enough to be affordable to low wage households. Rent subsidies provided by government programs without acquisition and development funding are more cost-efficient way to create housing opportunities. However, they do not come with heavy political support which comes from various parties who profit from real estate development… For the family in this article, what if the owner had a grant to write down his/her debt to zero in exchange for affordable rent for a certain number of years? If the unit or common areas needed to be improved, the owner would need to do that with their own resources first. Alternatively, there can be an actual rent subsidy provided for the eligible unit owner and family. The Chicago Low Income Housing Trust Fund has these kind of grant and rent subsidy programs. If the Trust Fund it were funded with infusions from TIFs or other big sources from high end developers, we could keep more local ownership and mixed income housing in Pilsen, Logan Square and other neighborhoods of Chicago

My family members live on Chicago’s South Side and the rents are affordable tbere. I just left San Francisco where people are paying $4, 000 a month rent. You can’t find a studio for $1300 a month in Oakland. Chicago doesn’t have a low vacancy rate and some rentals there are dirt cheap compared to New York City and the San Francisco Bay Area. I hope that Chicago doesn’t price working class people out. But, three adults paying $1300 for a two bedroom apartment sounds like a steal to renters in New York City and the SF Bay Area. Ijs

Rohrback hit the nail on the head. An actual practical plan that could work. Of course it needs political will to work. The Mayor has none for this. But we do. So let’s get on it!

mimi harris

Affordable housing, what happen to CHA and all the non-profits in those communities that were supposed to be the leaders in making sure Affordabke housing be a priority?

The Chicago Housing Authority has been closed for everyone except for seniors and people who meet the minimum annual income requirements since 2008. Therefore, people who are making less than $14 an hour are still having difficulties being able to afford some form of housing.

An example would be myself who attends community college in Chicago full-time and works part-time. I am extremely low-income, but I do not have any way to afford housing. I can not even afford a studio for $500-600 a month, so I am technically homeless. Personally, I wish there were more options for affordable housing, especially for people in conditions like mine, but there aren’t many if any are left.

“historically Latino neighborhood of Logan Square” . This is so wrong on so many levels, I cannot take the article seriously. The author, Mina Bloom, has a propensity for clickbaity gentrification articles about Logan Square. Feel free to look at the dnainfo archives about Mina’s past work. Apparently, it is easier to get view counts on this trash.

Hello,

Thanks for reading.

Latino settlement in Logan Square started in 1960. Read more here: http://www.encyclopedia.chicagohistory.org/pages/761.html

– Mina

…and from 1889 – 1960? This time period includes many more years and should be included in any historical analysis. Saying Logan Square is historically Latino is completely inaccurate.

Also, according to the site you linked…1960 wasn’t listed as any notable Latino population. It is not like 50,000 Latinos moved to Logan Square all within a few years. Most likely it was gradual, taking at least 10-20 years meaning 1970 at the earliest, probably 1980 where it had sizeable Latino population. So, historical Latino neighborhood, it is not.

>”many more years”

it’s like 10 more years dude

No it isn’t. 1889 to 1980 = 98 years , while 1980 – 2017 = 37 years

correction:

1889 to 1980 = 91 years versus 1980 – 2017 = 37 years….which is more historical?

Rent controls while understandable as a needed address to both gentrification and increased cost of living, do not address the fundamental structural problems of low wages, lack of universal healthcare, lack of access to nutrition, the worst education system in the western world, infrastructure that is falling apart, and a federal government’s insistence on spending more on its military than the next 10 largest military spenders in the world – $700 billion that is sucked out of productive social endeavors and squandered on weapons of destruction.

The City already has what the author wants – rent stabilized apartments. We don’t need rent control. Any apartment subsidized as affordable housing and any home purchased with affordable housing incentives both require long term affordability. As rentals the units must be rented affordably for as long as 40yrs in some cases. For homeownership, the property generally has to be sold affordably for a 30yr period.

Illegal aliens who have gobbled up lord knows how much $$$ worth of infrastructure and social services (and have they paid payroll taxes? and if so how do they do this ostensibly without social security numbers?) over 23 years, then complain they can’t afford to live here. Understand that your daughter received a FREE education from Illinois and Chicago taxpayers, which over the course of 12 years probably averaged around $12k a year, so you’ve actually done pretty well to bilk us out of $144k. No, I really don’t feel sympathy for illegals who benefited from under-market rents who suddenly realize that America is not a 100% free lunch like they thought.

They pay taxes as well. Don’t forget that. They haven’t taken anything from anyone.

Wait… They were illegal immigrants, and their complaint is that the cost of living became too high? Umm… Ok. They could move to a place in Lawndale, West Humboldt or the Austin neighborhoods. But, let’s instead put cost controls in place on everything. You want to write articles for a living?.. You can only make $14 per article. You want to sell amazing home made tamales?.. You can only charge 50¢ each. You want to run your business as a painter?.. You can only charge $150 to paint an apartment. You want to sell your art?.. Art can be sold for $35. You want to sell your car?.. You can only sell it for $2000. It doesn’t matter that the car is a classic 1942 Buick with a supercharged 427ci power plant and a 4:11 Ford 9″ that’ll boil the bologna and lift the front end at launch. Sounds a bit ridiculous, doesn’t it? The market will decide what things cost. And, maybe I can’t afford them. I want a deluxe apartment in the sky… But, I live in a house that I bought. I’ve committed to investing in this city, with increasing property tax dollars being paid every year. But, we’re arguing about protecting those who’ve refused to commit and invest with their property tax dollars. It’s proposals like this that are why we have a turd for a president. This is overreaching to an extreme.

I’m debating whether to apply for a position at City Colleges of Chicago because they require employees to live within the city limits. I’m not sure I would be able to afford an apartment in a safe area in Chicago.