By Laura Putre.

During the height of the foreclosure crisis, more than 10,000 individuals and families across the city of Cleveland faced losing their homes in a single year. My home in suburban Lakewood, bought in 2010, was a foreclosure in 2007. Four of the ten homes nearest it, including the house next door, were foreclosures, too.

I moved in too late to know any of the people who lost their homes, so I just hear bits and pieces. They weren’t all angels; who said they had to be? The former owner of my house, I’m told, lived with her grandchildren, a couple of hardened teens who tormented the neighbors. Next door, say the neighbors, was a woman so hated by her landlord, he decided to foreclose to remove her from the property.

The houses have new occupants now, kids and pets and their required adults. But even with all the action happening here, I feel like we’re living with ghosts. Ten thousand-plus people — and that’s just in one year — have to go somewhere, whether it’s the next street over or a trailer park or to another state. During the foreclosure crisis, there were a lot of stories about people losing their homes; but now that they’re gone, we hear very little about where they actually went. Are they living out their golden years in a small rental a few streets away from their home of 40 years, like a couple I know? Or maybe they’ve gone back to West Virginia to live with family they can’t stand.

I wanted to see how hard it would be to find people who’d lost their homes to foreclosure, to track what happened to them. I wanted three, for contrast’s sake. And they’d have to talk on the record.

It wouldn’t be too hard, right? Everyone in Cleveland knew someone who’d lost a house, from their Aunt Phoebe to the displaced neighbor whose washing machine they bought for 50 bucks. And if word of mouth and the collective brain-wracking of Facebook friends failed, surely I’d find someone in the constellation of Cleveland social service agencies that deal with foreclosure.

But this story became “A Tale of Two Foreclosures” (I think Dickens would approve) when, after a month of trying, I still couldn’t find a third family who’d lost a home to foreclosure who would let me use their names and tell their story.

******

One of the people who did talk to me was Sheri West, a youthful grandmother who reads motivational books and likes to network in her spare time. West lost her home in 2008, the second-worst year of Cleveland’s foreclosure crisis. I got in touch with her through LinkedIn, where her profile describes her as a “visionary entrepreneur,” though for the time being she’s working through an agency as a home caregiver for seniors.

The world has heard about West before. In 2009, when she was living at a shelter amid the houseplants she’d rescued from her former home, she was the subject of a New York Times article on a rise in foreclosure victims checking into homeless shelters. The writer described West driving around with the plants, her hats, and her flowered dresses on the night she was ousted from her house.

I remembered the article and wanted to know how she was doing. Better. Four years after checking into a homeless shelter, West is now living in Euclid, in a rent-subsidized apartment complex surrounded by industrial parks. The shrubbery is a little scraggly, but pink roses bloom. Bright gold door knockers punctuate the quiet hallways.

After that first night in her car, West spent nine months bouncing from acquaintance to acquaintance. It was easier to ask an outsider for a place to stay, she says, than someone in her family.

“Everybody’s out there hurting for money,” West says of her family, including her three grown children. “You can’t just go to somebody and say, ‘can I borrow something?’ They don’t have it either.”

She was careful to limit each stay to around three months. “My mother always told me, ‘Don’t wear out your welcome,’” says West. “Because people, they will say yes but they really don’t want to. They’re just trying to be nice, to help you out for a while.”

After two such moves, she stayed with an upbeat woman she knew only a little through a business networking group. Thankfully, they hit it off. During the time she camped out there, they brainstormed a lot. West was able to sign up for food stamps and map a plan for her life. But then she heard the clock ticking again. “I started thinking, ‘You know, I can’t stay with her forever. I have to put my pride aside and go to a shelter.’”

If you’re not a good housekeeper, they have a caseworker train you to keep house, she adds (though she’s a good housekeeper). They’ll give you pots and pans for your new home and a turkey on Thanksgiving and Christmas.

But the shelter was booked. The person who answered the phone told her to call back every day to see if a spot opened up.

“I did exactly what she said,” West recalls. “They got used to who I was. I would call and they would say, ‘Hey Miss West, how you doing? No, we don’t have an opening. Keep calling.’ So that’s what I did.”

After two months of calling (“I didn’t miss a day,” she declares), she got in. “That was one of the best decisions I made.” She was able to extend her stay at the shelter for a month or two beyond the 90-day limit, then found an apartment. WSCC helped her make rent for a year while she worked part-time.

Today, West is still working as a caregiver and dreams about starting her own business. And maybe someday she’ll buy another house. “There’s a program right now in Euclid,” she says. “You can get a house for $5,000. And they will assist you in getting a $10,000 loan [for repairs]. Once you fix the house up, they will give you the deed, so the house is yours free and clear. I’m thinking about doing that.”

Sometimes, when her bedroom gets too hot in summer, she’ll come into the living room where it’s cooler and sleep by her plants.

“I’m happy now,” she says. “It was a learning experience for me. I had to go through that. I’m in a different place now. I like it. I really like it.”

*****

Kirsten Rosebrock-Hayes and her husband, Tom Hayes, are on paper a world away from West, who took a few courses at a community college and worked in service jobs before she started running her own group home. Kirsten and Tom have four masters’ degrees between them and professional jobs as librarians. West is black, her children are grown; Kirsten and Tom, who are white, have two small children. West couldn’t rely on her family and had no savings; Kirsten and Tom enjoyed the benefits of both.

Kirsten didn’t panic in 2011 when Tom got laid off from his job as a head librarian at Case. She also stayed comparatively calm that December, when they stopped paying their mortgage, and the following August, when, after falling way behind on their credit-card payments, they decided to declare bankruptcy.

“I told my husband, ‘I feel like I’m at the top of a high dive and I don’t want to jump in,’” she recalls of signing the bankruptcy papers. “And he said, ‘You just have to jump.’”

It wasn’t until last May, when the bank finally came to take their 1800-square-foot home in Cleveland Heights, that Kirsten got scared. The couple has two kids in elementary school, and they weren’t sure where they were going to lay their heads at night.

“I was such a Pollyanna about everything,” she recalls. “From the minute my husband got laid off, I thought ‘everything’s going to be fine; things are going to be great.’ And finally this spring, right towards the end of school, I really started to break down: ‘I don’t know what’s going to happen!’ Because at that point we did not have anywhere to live, but we had to get out.”

The couple’s troubles begin as far back as 2003, when they refinanced their home on East Overlook. They had paid $129,000 for it in 2000. They took out a $30,000 home equity line of credit, and used the money to make repairs and pay off some credit card debt they’d racked up.

“Tom always said that was our first mistake,” says Kirsten. “We used our credit cards all the time back then. And really didn’t pay off the monthly balances.” They refinanced again in 2004 with $30,000 in credit card debt, right before the housing bubble burst; at the time, their home was appraised at $240,000.

When Tom lost his job, they owed $202,000 on a home that was worth $130,000 on a good day. Their house payments had ballooned from $1,000 to $1,800 a month. They couldn’t make their payments and they were under water, so they chose foreclosure.

But the family didn’t have to sleep in their car or entertain the idea of doing shelter drive-bys. When they got the notice from the county about the sheriff’s auction of their home, they were already in the market for a new one. They cashed in Tom’s $120,000 401K from his job at Case, which after taxes left them with about $100,000 to buy another place. *

When the bank came calling in May, Kirsten and Tom had put in an offer on another home in Cleveland Heights. Similar in age and size to their other home, it was a foreclosure that originally had been listed for $180,000, but the price had dropped considerably. Still, there were a few tense weeks of haggling with the realtor who was angling for a better offer than their $78,200. But it all worked out. They got the keys on June 6, three days before the date the bank told them they had to be out of their foreclosed home.

Even with Tom’s 401K, they had to do some financial maneuvering to get into the house. Cleveland Heights now requires that homebuyers put money in escrow to repair violations on their new homes, Kirsten says. The house needed a new roof and plumbing and electrical fixes that would cost an estimated $8,500. All told, they needed double that amount—half for the escrow, and half to pay the repair crews so they could get their escrow money back.

Tom was still out of work, but Kirsten, who’d worked part-time since 2005, had taken a full-time job as the Upper School librarian at Laurel, a private girls’ school. Their bankruptcy still fresh, they couldn’t get a loan. Instead, Tom’s parents agreed to take out a loan and lend them $20,000 with the agreement that Tom and Kirsten would pay them back.

With three days to move, they just started “packing like crazy,” says Kirsten. “We did not do a lot of purging. We didn’t have time to go through our stuff. So we’re doing that more on this end.”

When I visited them in August, a repair crew’s ladder blocked the front door and the family’s belongings were crammed onto every available surface; they hadn’t had much time to put things away from the move. As I sat on one of their broken-in couches, I wondered how they had gotten into so much trouble. Their possessions weren’t extravagant. In addition to Tom’s job loss, Kristen figures it all started by paying for everything with credit cards and then not paying the balance every month. And after her daughter was born in 2005, she switched from full-time to part-time work, so they lost some of their income.

“We really don’t have anything. We’ve thought, ‘Oh my gosh, you could take everything in our house and sell it at a garage sale for a couple thousand dollars. Maybe.’ We don’t go on crazy vacations. I don’t buy designer purses.”

I marveled at how they managed to buy a house with a fresh bankruptcy and foreclosure on their credit record. “It’s pretty impressive,” says Kristen. “We have the title to this house. It’s really weird. Most people, you’ve been in the house like 30 years and you have a party because you finally have the title. We own this house. But good luck getting a loan.”

****

David Rothstein, director of resource development and public affairs for Neighborhood Housing Services, is the co-author of Broken Homes, Broken Dreams, a study with the Poverty Center at Case Western Reserve University that looked at 29 families’ experiences with foreclosure.

Only a few of those families had reached the point where they actually lost their homes. But the researchers’ interviews with them suggested that they had “achieved a greater sense of stability” than families still in foreclosure Siberia. “Having moved out of their homes,” the families who lost homes “were moving on with their lives.”

But it was hard to know the whole story, because the researchers just couldn’t track down many families who’d actually lost their homes. They had “disappeared from the reach of service providers,” the study said. “Gaining a more complete understanding of the experiences of these families … is critical to realizing the full impact of foreclosure. How can policy and programs be shaped to increase the possibility of ‘success’ for these families?”

Rothstein says no one tracks what happens to people after they lose their homes to foreclosure. “This is a real unfortunate thing,” he says. “When we started this research project with the Poverty Center, we had a problem because there’s no central database for that.”

The lack of follow-up troubles him. “These are people who are part of our community,” Rothstein says. “Their housing and their lives are as just important as anyone else’s, and oftentimes their needs are things we can correct.”

Cities also need to track these people, to plan accordingly, says Rothstein.

“We need to know if people are becoming renters,” he says. “That matters a lot for rental housing, when you can make sure you have enough safe and appropriate-price rental housing if that’s where they end up going. If they end up with their parents, that’s important for us to know, too. One of the things we started picking up on with this study, are the financial strains [foreclosure] puts on extended families.”

Rothstein actually tracked down a third source for me: an NHS client in Bay Village who had been idling in foreclosure for five years after she lost her job as an operating engineer and got two payments behind on her mortgage. But she didn’t fit my description, not having lost her home.

“It’s a hard thing to find someone who’s gone completely through foreclosure,” he said. “You’re missing the pivotal information that one would have if they had a house: their phone number or an address or an email. That makes it challenging.” He adds that if NHS hasn’t been able to help a client keep their house—their success rate is 53 percent—that client probably wouldn’t answer NHS’s request to talk about the experience anyway.

Rothstein hopes that a new NHS program, the Greater Cleveland Stability Project, will better link foreclosure victims, before and after they’ve lost their homes, to agencies that provide things like food, unemployment and rental assistance. Clients will also receive more help with budgeting and assessing their finances.

“In doing our research study, it occurred to us as we were talking to people, that there’s a lot of programs that are supportive of economically fragile families,” says Rothstein. “But a lot of people going through foreclosure, they’ve never entered that type of situation, so they don’t know those resources are there or they feel embarrassed or they don’t know how to navigate them.”

******

Perhaps it’s better to have just two stories. Sheri and Kirsten have more in common than you might think. Both lost their homes. And both hustled to lift themselves out of a tragic situation. Sheri’s resources were her own persistence, a knack for sizing up helpful strangers, a willingness to ask people for things, and the maturity to wait for the right opportunity. Kirsten’s resources were money, education, and family. Even when their finances were a mess and their credit in the basement, both women showed pluck and tenacity, staying up nights figuring out their next move. They make me think about that quote from journalist Alex Kotlowitz, who said he wanted to cover the foreclosure crisis in Cleveland because the people in Cleveland push back.

Both women seem optimistic about the future. Sheri looks forward to the day when she can own her own business. And Kirsten talks about being able to take out a loan in three years for improvements on her new home. But I’m still left wondering: did we learn anything from this crisis? Collective memory fades if the victims have moved out of town, or are essentially voiceless because they’ve been knocked down a few notches on the class scale. If we don’t continue to follow these stories after the bank comes in and the vacate stickers go up, I fear we won’t learn a thing.

Laura Putre is managing editor/senior writer at Belt.

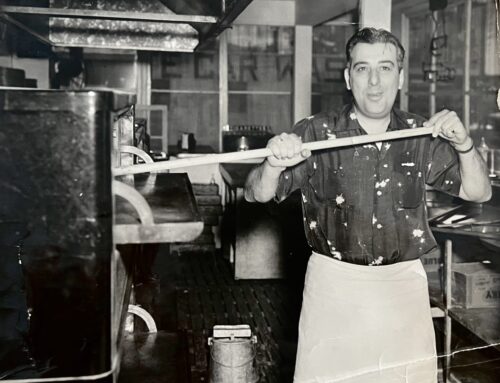

All images by Karin McKenna

*Corrections 10/17/13: The original story misstated that they had $75,000 to buy another home. Due to a WordPress error, the story also misstated that the original refinancing was a home equity loan, not cash, and the $30,000 in credit card debt was paid off on the second loan, not the first.

“A Tale Of Two Foreclosures” by Laura Putre appears in Dispatches from the Rust Belt: The Best of Belt Year One, our first-year print anthology. Order the book here: http://bit.ly/BestOfBelt

I have two comments:

First, it shocked me to learn that no one was, until now it seems, making any effort to reach out to people in foreclosure or who had lost their homes in any kind of organized fashion. It (foreclosure) is so clearly the exact spot where people fall through that proverbial crack. So, thank you Belt magazine for this moving, illuminating, and timely piece.

Second, I look forward to each issue of Belt! With the decline of newspapers in our town, we desperately need Belt to tell our stories. And it does, with humor, compassion, and intelligence.

thank you, Sheryl! We really appreciate your nice words.

“They cashed in Tom’s $120,000 401K from his job at Case, which after taxes left them with about $75,000 to buy another place.”

They should fire their accountant and amend their taxes. 10% penalty is $12K and if he was laid off he couldn’t be above a 15% tax bracket. Even with state and local taxes added there seems to be about a hefty $18,000 missing.

Blame my rusty math skills, not the accountant. It should be “about $100,000.” Thanks for reading.

It is concerning that it is so difficult to find what people’s lives are like after foreclosure. I hope some safety net has caught them and helped them bounce back onto their feet.I fear that this isn’t the case, though. And, I hope that the two strong, smart women that were profiled in this story are representative of other people’s untold stories. But I fear that their cases are not representative. Thanks for introducing us to these women. I wish Sheri and Kirsten and their families a peaceful, homey future.

Thanks for this smart and touching portrait.

I’m unsettled by the fact that, even after all of their financial strife, the married couple are (according to the article) dreaming of the day when they can take out a loan to rehab their new home. If I were them, I would operate on a cash and carry basis for a very long time and develop a savings strategy to upgrade as money is available. I hope I am wrong, but they seem headed for a repeat of their strife if they don’t make some serious changes. Belt is such a bright spot. So glad for it’s existence.

I’m the subject. We happened to mention offhand that, if we *wanted* to get a loan, we wouldn’t be able to do so for at least 3 years. We haven’t used credit cards in over 3 years and don’t plan to do so ever again. If we can’t afford it, we can’t buy it. So, I agree with your assessment. We plan to have this be a one-time learning experience, and learn from our mistakes.

I have the same concerns as Carole. Bankruptcy is meant to give you a fresh start. . .which is exactly what this couple received. They now own a home free and clear and are in an excellent position. We have this perception that we need credit to do certain things. This is faulty thinking. Using cash saves a substantial amount of money and puts you in a stronger, more stable financial situation. We need more voices reminding us that there is an alternative to credit and there is a better way.

I agree completely with Carole and Athena. There is a great article by Brent White from the University of Arizona on this subject. White describes how credit in this country has slowly translated into a moral judgment of people. Interestingly, of course, the same standard doesn’t apply to businesses, which apparently have no moral responsibility to anyone. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1494467

Most people I know of who lost their homes did one of two things;

1 – financed out their equity, took the money and spent/used it for something else.

They borrowed it, without consideration apparently for having to repay it, feeling like it was bonus money.

2. Bought more than they could afford, getting into the crazed buying as the housing market ran up.

Then they decided they didn’t need to repay the loan and walked away.

Of course banks lent. A nd people often got homes with no money down–no skin in the game if they walked away.

My house that I bought low just turned around enough for me to refinance a higher interest loan.

I’m really torn about so many people walking away from the money they owed. Again, most people I know who got in trouble didn’t lose their jobs–although some did. They spent the money or over-borrowed. People making less than me, bought far more, and I wondered how long the AZ income would hold up to the housing prices. Sad Sad state and we all pay for it, not just the banks. My house was underwater for years, and I kept paying. Luckily Like at least one friend I know, I kept my living. The friend I reference had added problems that caused her to refinance equity out, and that was taking care of an aging father moving into dementia, and taking care of a grandson. These affected her finances and her ability to keep up with her job. It was not the economy but her circumstances, and the economy compounded it, AND the banks lent her the money.

I used to work in a computer training program for unemployed adults. I got to know several people who lost their homes. Several of the single women were living with relatives and didn’t feel welcome. Another single woman had been living for several months in a homeless shelter. There was a married couple who evntually moved into a one bedroom apartment after losing their four bedroom home to foreclosure. Even though they had medical insurance, they had filed bankruptcy over medical bills that did not fully cover an accident and illness. All of these people had held full time jobs before the recession.